Biden's $10 Billion Iran Waiver: Unpacking A Controversial Decision

Table of Contents

- The Genesis of Frozen Assets and Sanctions

- Unraveling the $10 Billion Waiver: Mechanisms and Details

- Why Now? Timing Amidst Regional Strife

- Critical Voices and Allegations of Funding Terrorism

- The Biden Administration's Stance and Lack of Clarification

- Iran's Economic Landscape: Before and After Sanctions

- Geopolitical Ramifications and Future Uncertainties

- Conclusion: Navigating the Controversy

The Genesis of Frozen Assets and Sanctions

To comprehend the significance of the recent decision where **Biden gives Iran $10 billion**, one must first understand the historical context of Iran's frozen assets and the comprehensive sanctions regime imposed by the United States. For decades, particularly following the 1979 Islamic Revolution and the hostage crisis, the U.S. has utilized economic sanctions as a primary tool to pressure Tehran over its nuclear program, human rights abuses, and support for international terrorism. These sanctions have targeted various sectors of the Iranian economy, including its oil exports, banking system, and access to the international financial system, leading to significant portions of its foreign reserves being held in escrow accounts in other countries, inaccessible to the Iranian government. The objective of these frozen assets and sanctions has consistently been to limit Iran's financial capabilities, thereby impeding its ability to fund its illicit activities and destabilizing regional ambitions. Over the years, the amount of Iran's reserves has fluctuated dramatically under the weight of these measures. For instance, data indicates that in 2018, Iran held over $122 billion in reserves, a figure that dramatically tumbled to just shy of $15 billion due to the stringent application of sanctions. This stark reduction underscores the effectiveness, or at least the severe impact, of the sanctions regime on Iran's economy. The recent unfreezing of funds, therefore, represents a significant shift in this long-standing policy, prompting widespread scrutiny.Unraveling the $10 Billion Waiver: Mechanisms and Details

The core of the current controversy revolves around a series of sanctions waivers that have allowed Iran to access substantial sums of its previously frozen assets. Specifically, the data indicates that "Two separate agreements in the fall allowed Iran to access up to $16 billion of its previously frozen assets, including a reported $10 billion as the result of an extension of a Trump-era waiver." This suggests a continuity, yet also an expansion, of certain policies. The critical piece of information is that "On Tuesday the State Department reissued a sanctions waiver that gives Iran access to more than $10 billion." Furthermore, it's confirmed that "The Biden administration renewed a sanctions waiver on March 13 that grants Iran access to $10 billion in previously escrowed funds." This confirms the specific amount and the mechanism of access. The funds are not directly transferred from U.S. coffers but are rather released from accounts in other countries where they were held due to U.S. sanctions.The Iraq Connection: Electricity for Euros

A significant portion of these funds is linked to Iraq. "The decision, coming amid the Gaza war and Iran's backing for Hamas, would effectively unfreeze an estimated $10 billion that Iraq owes Iran but cannot pay due to US sanctions." This highlights a specific financial pipeline: "We reported on the $10 billion in Iraqi energy payments when President Biden unfroze them for Iran’s use in July 2023, and again when he extended the sanctions waiver this past November." This clarifies that the funds are primarily for electricity purchases by Iraq from Iran. Crucially, the waiver "allows Baghdad to continue purchasing electricity from Iran and, in a change from past policy, for Iran to convert its revenue into euros and draw on the money for..." This detail about converting revenue into euros is particularly significant. Previous waivers often restricted how Iran could use the funds, typically for humanitarian goods or specific non-sanctioned purposes. The ability to convert to euros grants Iran "far more leeway in how" it can utilize these funds, as one source noted, potentially making them more fungible and accessible for a wider range of activities, including those deemed problematic by critics.A Timeline of Waiver Extensions

The release of these funds was not a single event but a series of extensions and reapprovals. "The Biden administration on November 14 extended a sanctions waiver to allow Iran to access upwards of $10 billion in electricity revenue once held in escrow in Iraq." This was followed by another reapproval: "The Biden administration on Wednesday reapproved a sanctions waiver that unlocks upwards of $10 billion in frozen funds for the..." and "The Biden administration on Tuesday reapproved a sanctions waiver that will allow Iran to access upward of $10 billion in frozen assets, the State Department confirmed to the Washington Free Beacon." These multiple instances underscore a consistent policy choice by the current administration to facilitate Iran's access to these funds. The fact that some of these decisions, particularly the one on March 13, 2024, are quite recent, keeps the issue at the forefront of foreign policy discussions.Why Now? Timing Amidst Regional Strife

One of the most pressing questions surrounding the decision to let **Biden gives Iran $10 billion** is the timing. The data explicitly states, "The decision, coming amid the Gaza war and Iran's backing for Hamas," immediately links the financial move to the volatile geopolitical landscape. The conflict in Gaza, which erupted in October 2023, has significantly escalated tensions across the Middle East, with Iran-backed groups like Hamas, Hezbollah, and the Houthis playing active roles. Critics argue that providing Iran with access to such substantial funds at a time when its proxies are engaged in conflict with U.S. allies, particularly Israel, sends a contradictory message and potentially strengthens these groups. The concern is that even if the funds are nominally for humanitarian or electricity purposes, the fungibility of money means that other resources can be diverted to support military or destabilizing activities. As one tweet highlighted, "Why did Joe Biden just give 10 billion dollars to Iran?" — a question that encapsulates the public's bewilderment and concern over the apparent timing. The implication that this happened "3 days after election" (though the provided date of December 11, 2024, suggests a future election or a misinterpretation of a past one, given the context of other dates like November 14, 2023, and March 13, 2024) further fuels speculation about political motivations behind the timing.Critical Voices and Allegations of Funding Terrorism

The decision has not been met with universal approval; indeed, it has drawn severe criticism from various quarters. A particularly strong accusation is that "Biden renews a sanctions waiver that helps fund terrorism." This grave allegation stems from the belief that any funds made available to the Iranian regime, directly or indirectly, could be used to support its network of proxy groups, including those designated as terrorist organizations by the U.S. The argument is often made that money is fungible; even if the released funds are earmarked for specific purposes like electricity payments, they free up other Iranian resources that can then be diverted to military or clandestine activities. This concern is amplified by Iran's well-documented history of supporting groups like Hamas and Hezbollah, which are actively involved in regional conflicts. Critics contend that by easing financial pressure, the Biden administration is inadvertently, or perhaps even directly, enabling Iran's destabilizing actions. The sentiment that this is "Rotten to the very end" reflects a deep-seated frustration and distrust among those who believe the administration is being too lenient with a hostile regime. These allegations underscore the YMYL aspect, as decisions related to funding states accused of terrorism directly impact national security and potentially the lives of citizens.The Biden Administration's Stance and Lack of Clarification

Despite the widespread concern and criticism, the Biden administration's public clarification regarding the timing and broader implications of these waivers has been notably sparse. As the data points out, "As neither Iran nor the Biden administration has provided clarification, questions linger about the timing and broader implications of this decision." Similarly, "Neither Iran nor the White House have reacted to the report yet," suggesting a deliberate silence or a lack of proactive communication on such a sensitive issue. This lack of transparency has only exacerbated public and political apprehension. Without a clear explanation of the strategic rationale, the specific safeguards in place to prevent misuse of funds, or the long-term foreign policy objectives these waivers are intended to achieve, critics are left to speculate on the administration's motives. This absence of direct engagement on the issue undermines trustworthiness and fuels narratives of appeasement, particularly given the concurrent regional conflicts. For a decision of such magnitude, impacting U.S. national security and foreign policy, the expectation for detailed justification is high, and its absence is a significant point of contention.Iran's Economic Landscape: Before and After Sanctions

The impact of sanctions on Iran's economy provides crucial context for understanding why access to $10 billion is so significant. As mentioned earlier, "In 2018, Iran held over $122 billion in reserves, which tumbled to just shy of $15." This drastic reduction, primarily due to the "maximum pressure" campaign under the previous U.S. administration, crippled Iran's ability to engage in international trade, finance essential imports, and fund its domestic programs. The goal of such sanctions was to bring Iran to the negotiating table over its nuclear program and regional behavior. From Iran's perspective, accessing these frozen funds is a matter of economic necessity and sovereignty. The funds, though frozen by U.S. sanctions, are considered Iran's legitimate assets. The ability to convert Iraqi electricity payments into euros provides a vital lifeline, allowing Tehran to procure goods and services from international markets, potentially easing domestic economic pressures. However, from the perspective of those who advocate for continued pressure on Iran, any financial relief, regardless of its intended purpose, diminishes the leverage that sanctions provide and risks empowering a regime that remains a significant threat to global stability. The ongoing debate about **Biden gives Iran $10 billion** thus sits at the intersection of economic pressure and geopolitical strategy.Geopolitical Ramifications and Future Uncertainties

The decision to grant Iran access to these funds carries profound geopolitical ramifications, extending beyond the immediate financial implications. It signals a particular approach to Iran—one that, for critics, appears to prioritize de-escalation or humanitarian concerns over strict enforcement of sanctions aimed at isolating the regime. This approach could be interpreted by allies and adversaries alike as a weakening of resolve, potentially emboldening Iran and its proxies. The broader implications for regional security are significant. If the funds, directly or indirectly, enable Iran to further support groups like Hamas or Hezbollah, it could lead to increased instability, more frequent conflicts, and a heightened risk to U.S. personnel and interests in the Middle East. The delicate balance of power in the region, already strained by the Gaza conflict, could be further disrupted, leading to a more unpredictable and dangerous environment.The Shadow of a Trump Return

Adding another layer of complexity is the prospect of a change in U.S. administration. "With Trump’s return to the presidency imminent, his incoming administration will face the decision of whether to allow Iran continued access to these funds." This point is crucial because the previous Trump administration pursued a policy of "maximum pressure" on Iran, which included stringent sanctions and a near-total cutoff of Iran's access to its foreign reserves. Should Donald Trump return to office, it is highly probable that his administration would reverse the current waivers and re-impose stricter sanctions, potentially re-freezing the funds. This creates significant uncertainty for Iran, Iraq, and other international actors involved in these transactions. Such a policy oscillation could further destabilize the region, as Iran might react aggressively to renewed pressure, and it would certainly complicate long-term strategic planning for all parties involved. The current administration's actions are therefore not just about immediate policy but also about setting precedents that a future administration may or may not uphold.Broader Implications for Regional Stability

The decision where **Biden gives Iran $10 billion** also has broader implications for international diplomacy and the effectiveness of sanctions as a tool of foreign policy. If sanctions can be easily waived or circumvented, their deterrent effect diminishes. This could encourage other sanctioned regimes to believe they can outlast or negotiate their way around international pressure. Moreover, the perceived leniency towards Iran could strain relationships with key U.S. allies in the Middle East, particularly Saudi Arabia and Israel, who view Iran as their primary regional adversary. These nations have consistently advocated for a tougher stance against Tehran, and any move that appears to financially empower Iran is likely to be met with apprehension and potentially lead to their own recalibrations of security policy. The long-term impact on regional alliances and the overall stability of the Middle East remains a critical concern, making this decision a focal point for experts analyzing geopolitical shifts.Conclusion: Navigating the Controversy

The Biden administration's decision to grant Iran access to $10 billion in previously frozen assets is a multifaceted issue, deeply embedded in the complex tapestry of U.S.-Iran relations and the volatile geopolitics of the Middle East. While the administration has not offered extensive public clarification, the details gleaned from various reports indicate a series of sanctions waivers, particularly involving Iraqi energy payments, that allow Iran greater flexibility in accessing and utilizing these funds. The timing of these waivers, amidst ongoing conflicts involving Iran-backed proxies, has fueled significant criticism and raised serious questions about the potential for these funds to indirectly support destabilizing activities. Critics argue that such moves undermine the efficacy of sanctions and could inadvertently embolden a regime widely accused of sponsoring terrorism. The historical context of Iran's dwindling reserves under sanctions underscores the financial relief these waivers provide, further highlighting the strategic implications. As the debate continues, with the shadow of a potential change in U.S. leadership looming, the long-term consequences of this policy remain uncertain. Understanding this decision requires a careful consideration of its financial mechanisms, geopolitical context, and the diverse perspectives on its implications for regional stability and U.S. foreign policy. We invite you to share your thoughts on this complex issue in the comments below. Do you believe this decision serves U.S. interests, or does it pose a significant risk? Explore more of our articles for in-depth analysis of global affairs and foreign policy decisions that impact our world.

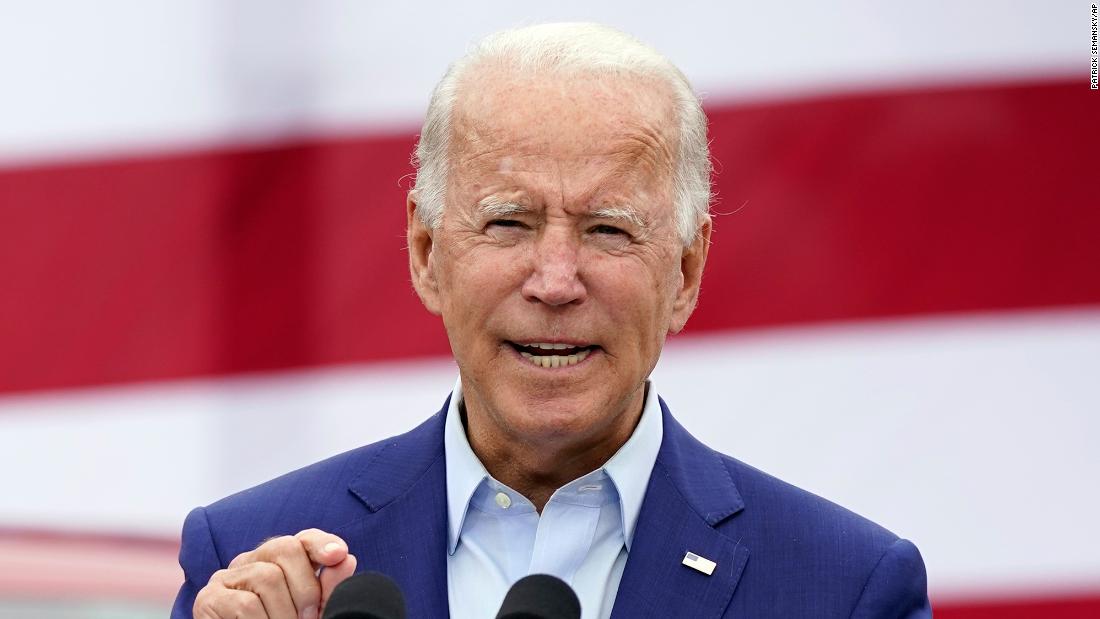

President Joe Biden announces 2024 reelection campaign

Veterans, stalemates and sleepless nights: Inside the White House

Joe Biden CNN town hall: What to know about his policy proposals