Sending Money To Iran From USA: A Comprehensive & Safe Guide

Navigating the complexities of international money transfers can be daunting, especially when dealing with countries under sanctions. If you're looking for information on how to send money to Iran from USA, you've likely encountered significant hurdles. Traditional banking systems and popular money transfer services often fall short due to stringent regulations. This article aims to demystify the process, providing you with expert insights and reliable methods to ensure your funds reach their destination securely and legally.

Transferring money across borders, particularly from the United States to Iran, is not a straightforward task. The geopolitical landscape has created a unique set of challenges, making it crucial to understand the legal framework and available options. While it might seem impossible at first glance, transferring money to Iran has become possible through specific channels designed to comply with U.S. regulations. We’ll delve into the intricacies, compare top providers, and offer practical advice to help you send money from the USA to Iran effectively.

Table of Contents

- Understanding the Landscape: Why Sending Money to Iran is Complex

- Permissible Pathways: What the Law Allows

- Exploring Your Options: How to Send Money to Iran Online

- Comparing Providers: Finding the Best Way to Send Money to Iran

- Key Considerations: Exchange Rates, Fees, and Speed

- Step-by-Step Guide: Sending Money Safely

- Receiving Money in Iran: What Your Recipient Needs to Know

- Frequently Asked Questions About Sending Money to Iran from USA

Understanding the Landscape: Why Sending Money to Iran is Complex

The primary reason behind the difficulty in sending money to Iran from the USA stems from a complex web of sanctions imposed by the U.S. government. These sanctions are designed to restrict financial transactions with Iran, making it challenging for individuals and businesses alike. Unlike many other countries where you can easily compare Xe, WU, MoneyGram, and other options for online transfers, Iran presents a unique scenario where these mainstream providers typically do not offer services.

The OFAC Sanctions and Their Impact

The Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury is the primary body responsible for administering and enforcing economic sanctions programs. The Department of the Treasury spells out the details of the sanctions and its exemptions. These regulations, particularly the Iranian Transactions and Sanctions Regulations (ITSR), prohibit most transactions involving Iran or the Government of Iran. This is why most U.S. banks will not handle a transfer to Iran for you, and popular money transfer providers like Western Union and MoneyGram don’t offer their services to Iran.

In fact, sending money to Iran for commercial purposes isn’t just challenging; it’s generally prohibited unless specifically authorized by OFAC. Even if you can find a money transfer service willing to help you send money to Iran, you will then need to be very careful about the purpose of the transfer. This emphasis on purpose is crucial because only certain types of transactions are permitted under specific licenses or exemptions.

Why Traditional Banks & Services Fall Short

Due to the extensive sanctions, traditional financial institutions and widely recognized money transfer giants like Western Union and MoneyGram have largely ceased operations involving direct transfers to Iran. Their global compliance frameworks often lead them to avoid any transactions that could potentially violate U.S. sanctions, even if an exemption exists. This leaves individuals seeking alternative methods for how to send money to Iran from USA, forcing them to look beyond conventional banking solutions.

- Alex Pall Age

- Tv Shows With Vivian Dsena

- Amanda Boyd Tiger Woods

- Swedish Pop Stars

- Jim Carreys Girlfriend

Permissible Pathways: What the Law Allows

Despite the broad sanctions, there are specific exemptions and licenses that allow certain types of money transfers to and from Iran. Understanding these permissible pathways is key to legally and safely sending money to Iran from USA.

Non-Commercial and Personal Transfers

A critical exemption under the ITSR authorizes the transfer of funds that are noncommercial and personal in nature to or from Iran, or for or on behalf of an individual ordinarily resident in Iran (other than an individual whose property and interests in property are blocked pursuant to § 560.211), subject to certain restrictions and limitations. This means that remittances for family support, educational expenses, medical treatment, or other personal needs are generally allowed, provided they meet specific criteria and are not for commercial gain.

This exemption is vital for Iranian immigrants and expats in the U.S. who need to reliably send money to friends and relatives in Iran. However, it's paramount that the sender and recipient ensure the purpose of the transfer strictly adheres to these non-commercial, personal definitions. Any deviation could lead to legal complications.

Exploring Your Options: How to Send Money to Iran Online

Given the limitations of traditional banking, individuals looking to send money to Iran from USA must explore specialized services and alternative methods. Transferring money to Iran has become possible through a handful of dedicated providers and innovative solutions that navigate the regulatory environment.

Specialist Iranian Money Transfer Services

Several companies specialize in facilitating remittances to Iran, often employing workarounds to deliver funds while complying with sanctions. These services understand the unique challenges and have established networks to ensure money reaches recipients. In this article, we’ll compare the top money transfer companies that can reliably send money from countries like the USA, Canada, England, Germany, and others to recipients located across Iran.

- Iranicard: If you’re trying to send money to Iran, Iranicard can help you. They often facilitate receiving and exchanging almost every currency in Iran within hours. Their process typically involves filling an application form, after which you’ll receive an email within 1 business day with further instructions.

- Rebit: Another service, Rebit, makes it easy to send money from the United States to Iran. These services usually operate by receiving funds in one country and then disbursing the equivalent amount in local currency in Iran through their local partners, thus avoiding direct transfers through the sanctioned banking system.

- Sarafirani: Sarafirani is highlighted as one of the fastest, cheapest, and most convenient options for sending money to your loved ones in Iran. They position themselves as a reliable and affordable money transfer service with services specifically tailored for customers needing to send funds to Iran.

These specialist services are crucial for individuals trying to figure out how to send money to Iran online, as they offer a viable and compliant pathway where others cannot.

The Role of Prepaid Cards

Prepaid cards represent another method that can be explored, though with certain limitations. Prepaid cards can be loaded with funds in the USA and then used by the recipient in Iran for various purchases or ATM withdrawals. This method circumvents direct bank transfers by providing a tangible card that can be used locally. However, the usability and acceptance of specific prepaid cards in Iran can vary, and ATM withdrawal limits or fees might apply. It's essential to research the specific card's international usability and any associated costs.

Emerging Alternatives: Cryptocurrency

The landscape of international money transfers is constantly evolving, and cryptocurrency has emerged as a potential, albeit complex, alternative. The Office of Foreign Assets Control (OFAC) in the United States has granted approval for the utilization of cryptocurrencies as one of the permissible methods to transfer the assets of Iranian individuals residing in Iran to the United States. While this statement specifically refers to transfers *from* Iran to the USA, it indicates OFAC's acknowledgment of crypto as a permissible channel under certain conditions. This implies that, with proper due diligence and understanding of regulations, cryptocurrency *could* potentially be used for transfers *to* Iran, especially for non-commercial, personal purposes, by leveraging peer-to-peer networks that operate outside traditional banking systems. However, this method requires a high degree of technical understanding and awareness of the volatile nature of cryptocurrencies, as well as strict adherence to all OFAC guidelines to avoid any legal pitfalls.

Comparing Providers: Finding the Best Way to Send Money to Iran

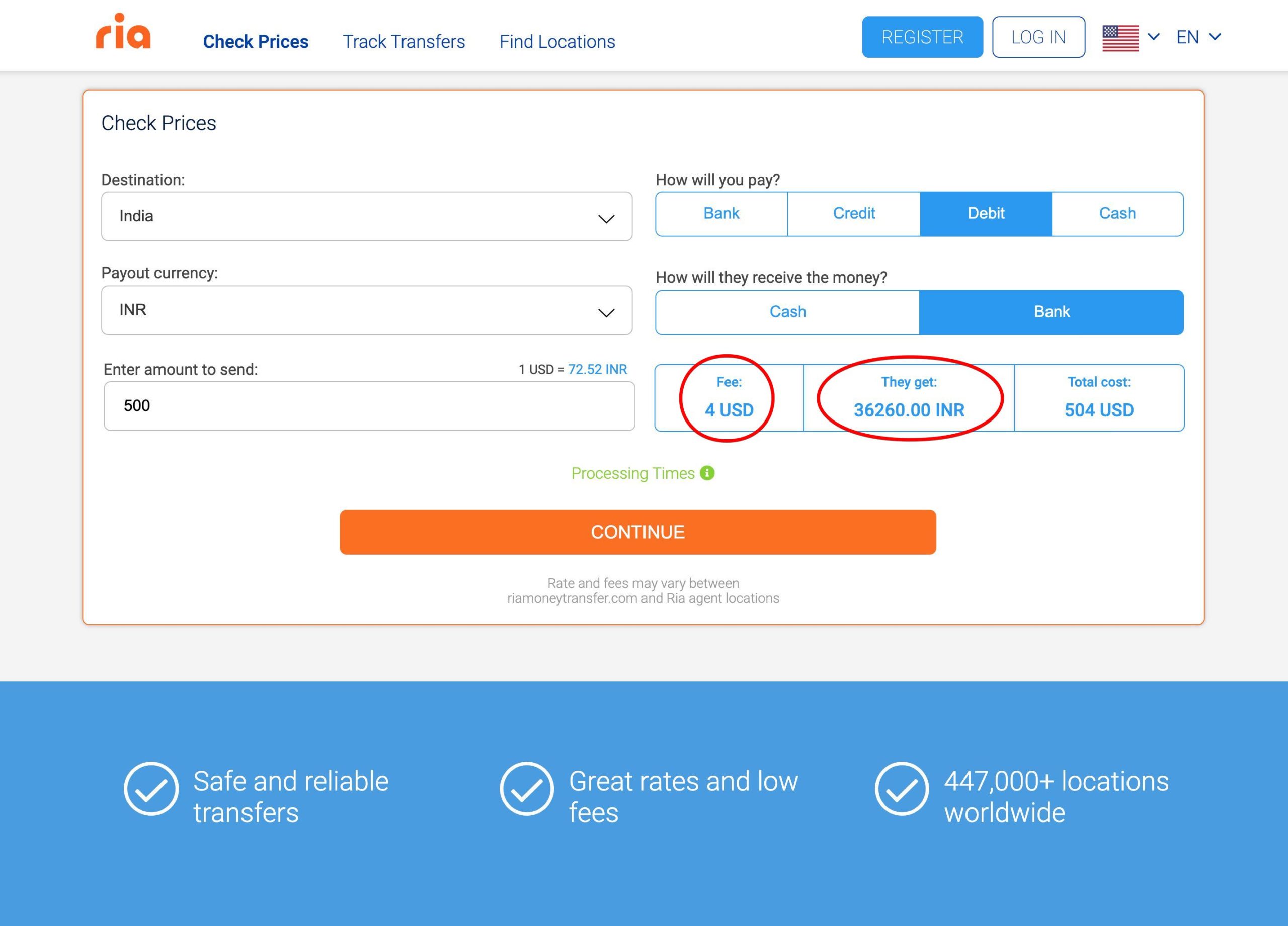

When seeking how to send money to Iran from USA, comparing providers is essential to find the cheapest, fastest, and most reliable options with the best exchange rates. While popular services like Western Union and MoneyGram do not directly serve Iran, the data provided indicates that MoneyGram was compared for overall speed in sending money from the United States to Iran, showing an average fee of 7.33 USD over a 7-day period. This suggests that while direct transfers are not possible, MoneyGram might be used as a benchmark for speed in general remittances, or perhaps through indirect channels not directly offered by MoneyGram itself to Iran. It's crucial to reiterate that direct services from these major players to Iran are generally unavailable due to sanctions.

Instead, focus your comparison on the specialist Iranian money transfer services mentioned earlier, such as Iranicard, Rebit, and Sarafirani. These are the providers that explicitly state their ability to help you transfer money to Iran. When comparing them, consider:

- Exchange Rates: Look for providers offering competitive IRR to USD exchange rates. Even a small difference in the rate can significantly impact the final amount received.

- Fees: Compare transfer fees. Some providers might have flat fees, while others charge a percentage of the transfer amount.

- Speed: How quickly will the money reach your recipient? Some services promise delivery within hours, while others might take 1-3 business days.

- Reliability and Reputation: Research reviews and testimonials to ensure the provider is trustworthy and has a proven track record of successful transfers to Iran.

- Customer Support: Good customer service can be invaluable, especially when dealing with complex international transfers.

Remember, the goal is to find a service that is fast, easy, convenient, and cheaper way of sending money to your loved ones, while strictly adhering to all legal requirements.

Key Considerations: Exchange Rates, Fees, and Speed

When you're trying to figure out how to send money to Iran from USA, three factors will heavily influence your decision: exchange rates, fees, and transfer speed. These elements directly impact how much money your loved ones in Iran will ultimately receive and how quickly they receive it.

- Exchange Rates: The exchange rate is the most critical factor determining the value of your transfer. Providers offering better IRR to USD exchange rates mean more Iranian Rials for every U.S. Dollar you send. Always check the live exchange rate offered by the service, as it can fluctuate. Some services might offer an attractive low fee but compensate with a less favorable exchange rate, effectively costing you more.

- Fees: Transfer fees can vary significantly. Some services might have a fixed fee regardless of the amount, while others charge a percentage. For example, while MoneyGram's average fee for general transfers from the U.S. was around 7.33 USD, this is a benchmark and not directly applicable to Iran. Specialist services will have their own fee structures. Look for transparent pricing and avoid hidden charges.

- Speed: How quickly the money arrives is often a priority. Some services boast "receiving and exchanging almost every currency in Iran within hours," while others might take a business day or more. If the need is urgent, prioritize speed, but be prepared that faster services might sometimes come with slightly higher fees or less competitive exchange rates.

It depends on which currencies you send and how you pay. For example, some methods might be faster but require a bank transfer, while others might accept credit cards but incur higher fees. Always compare these three aspects holistically to find the best overall deal.

Step-by-Step Guide: Sending Money Safely

Sending money to Iran from USA requires careful attention to detail and adherence to specific steps to ensure compliance and successful delivery. Here's a general guide:

- Understand the Purpose: Reconfirm that your transfer is noncommercial and personal in nature, as authorized by the ITSR. This is the most crucial step for legal compliance.

- Research and Select a Provider: Based on your comparison of exchange rates, fees, and speed, choose a specialist Iranian money transfer service like Iranicard, Rebit, or Sarafirani. Ensure they have a strong reputation for reliability in transferring funds to Iran.

- Gather Recipient Information: You will need your recipient's full name, contact details, and potentially their bank account information in Iran, depending on how the funds will be disbursed. Some services might offer cash pickup options as well.

- Complete the Application/Transfer Form: Most services will require you to fill out an application form online or through their platform. Provide all requested details accurately. You’ll typically receive an email within 1 business day with further instructions after submitting the application.

- Fund Your Transfer: Choose your preferred payment method (e.g., bank transfer, debit card, credit card). Be aware of any associated fees for your chosen payment method.

- Confirm and Track: Once the transfer is initiated, you should receive a confirmation. Most reputable services offer a tracking system so you can monitor the status of your transfer until it reaches your recipient.

- Communicate with Recipient: Inform your recipient about the transfer, including the expected arrival time and any necessary steps they need to take to receive the funds.

Always keep records of your transactions, including confirmation numbers and receipts, for your own records and in case of any queries.

Receiving Money in Iran: What Your Recipient Needs to Know

For your recipient in Iran, understanding how they will receive the money is just as important as knowing how to send money to Iran from USA. The methods of receipt often depend on the chosen transfer service.

- Bank Account Deposit: Many services can deposit funds directly into a local Iranian bank account. Your recipient will need to provide their bank name, account number, and sometimes an IBAN or SWIFT/BIC code (though SWIFT is less common for direct transfers due to sanctions).

- Cash Pickup: Some services offer cash pickup at designated locations in Iran. This can be convenient for recipients without bank accounts or those who prefer immediate access to cash. They will typically need a valid ID and a reference number provided by the sender.

- Prepaid Cards: If you've opted for a prepaid card, the recipient can use it for purchases or ATM withdrawals. They should be aware of any daily limits, transaction fees, and the availability of ATMs that accept the card in their area.

- Local Currency Exchange: Funds are almost always received in Iranian Rial (IRR). Services like Iranicard facilitate receiving and exchanging almost every currency in Iran within hours, ensuring the recipient gets local currency.

It's crucial for the recipient to be aware of the purpose of the transfer and to ensure it aligns with the non-commercial, personal nature allowed under U.S. sanctions. They should also be cautious of any scams or unsolicited requests for personal financial information.

Frequently Asked Questions About Sending Money to Iran from USA

Q: Can I send money to Iran through Western Union or MoneyGram?

A: No, popular money transfer providers like Western Union and MoneyGram do not offer their services for direct transfers to Iran due to U.S. sanctions. You will need to use specialized services.

Q: Is it legal to send money to Iran from USA?

A: Yes, it is legal to send money to Iran from USA, provided the transfer is noncommercial and personal in nature, as authorized by the U.S. Department of the Treasury's OFAC sanctions exemptions. Transfers for commercial purposes are generally prohibited.

Q: What information do I need to send money to Iran?

A: You will typically need your recipient's full name, contact information, and possibly their bank account details in Iran, depending on the service. The purpose of the transfer is also crucial for compliance.

Q: How long does it take to send money to Iran?

A: The speed varies by provider. Some specialist services can deliver funds within hours, while others may take 1-3 business days. Always check the estimated delivery time with your chosen service.

Q: Are there limits on how much money I can send to Iran?

A: While the "Data Kalimat" mentions a maximum of $1.8 million per transfer for sending money *from* Iran to the USA, limits for sending money *to* Iran from the USA for personal, non-commercial purposes will depend on the specific provider and their internal policies, as well as OFAC's general licenses. It's best to check with your chosen service for their specific limits.

Q: Can I use cryptocurrency to send money to Iran?

A: While OFAC has acknowledged cryptocurrency as a permissible method for transferring assets *from* Iranian individuals residing in Iran to the U.S. under certain conditions, using it for transfers *to* Iran from the U.S. is complex and requires strict adherence to all OFAC regulations. It's a high-risk option that demands expert knowledge and careful compliance.

Q: What are the best ways to find the cheapest fees and best exchange rates?

A: To find the cheapest, fastest, and most reliable providers with the best IRR to USD exchange rates, you should compare specialist Iranian money transfer services. Look at their advertised fees and live exchange rates, and read reviews to assess their reliability.

Q: Can I transfer money from Iran to the United States?

A: Transferring money from Iran to the United States, or vice versa, involves navigating a complex web of regulations designed to comply with U.S. sanctions. While challenging, several money transfer solutions make it possible for Iranian immigrants and expats in the U.S. to reliably receive money from friends and relatives in Iran. Similarly, there are methods for transferring funds from Iran to America, often through specialist services or approved cryptocurrency channels, subject to strict limits and regulations.

Sending funds from Iran to the United States can be quite challenging given the complex geopolitical situation between the two countries. However, several money transfer solutions make it possible for Iranian immigrants and expats in the U.S. to reliably receive money from friends and relatives in Iran. Iranians living in America have the option to transfer their funds from Iran to America through various means, including specialist services that help transfer money to USA from Iran at the best rate or even for free, within the legal frameworks.

In conclusion, while sending money to Iran from USA is undeniably complex due to U.S. sanctions, it is not impossible. By understanding the legal exemptions for noncommercial, personal transfers and utilizing specialized money transfer services, you can ensure your funds reach your loved ones safely and compliantly. Always prioritize due diligence, compare services carefully, and ensure the purpose of your transfer aligns with the regulations set forth by the Department of the Treasury and OFAC.

We hope this comprehensive guide has provided you with the clarity and confidence needed to navigate this challenging process. If you have further questions or experiences to share, please leave a comment below. Don't forget to share this article with anyone who might benefit from this crucial information.

- Is Joey Mcintyre Married

- Westchester County Airport

- Acqua Di Parma

- Who Is Kim Mulkeys Husband

- Yaya Mayweather Age

CAN I SEND MONEY TO IRAN? - LUMENWIRE

HOW TO SEND MONEY FROM IRAN TO CANADA? - LUMENWIRE

Best ways to send money from USA to India: Ria, PayPal or TransferWise?